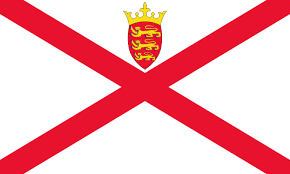

Jersey

Private Client

Introduction

Jersey is a British Crown Dependency, separate from the United Kingdom, allowing a high degree of autonomy, including its own fiscal and legal/judicial systems.

Jersey’s customary law jurisdiction is long-established, which has been influenced, inter alia, by Norman customary law, English common law and modern French civil law. The financial and legal sectors are substantial, renowned for expertise in areas such as trusts, banking, wealth, fund & asset management and family offices.

Jersey is recognised as a well-regulated, leading international financial centre dedicated to meeting the highest international standards set by a number of worldwide organisations and international regulatory bodies (including the EU, OECD, IMF and MONEYVAL) through the continued development and implementation of robust regulation and legislation.

As a low tax jurisdiction with a strong and respected regulatory framework, residents and businesses in Jersey benefit from growth opportunities in the comfort of a secure and compliant jurisdiction, ensuring the protection of their assets.

1 . Tax and wealth planning

1.1. National legislative and regulatory developments

See below Section 1.2. Although Jersey is not independent of the United Kingdom its status as a Crown Dependency gives it constitutional rights of self-government and judicial independence. Accordingly “national” and “local” developments will in this guide be treated as being the same.

1.2. Local legislative and regulatory developments

Jersey’s tax system is relatively uncomplicated. The standard rate of tax for Jersey resident individuals is 20% and there is no capital gains tax. There is a goods and services tax (GST) of 5% on the majority of goods and services supplied in the island, the tax also being levied on imports worth more than JEP 135. High value residents who are granted permission to become resident in Jersey must demonstrate an annual worldwide income in excess of JEP 750,000 and the minimum tax that they must pay is JEP 145,000 per annum. In general terms they are taxed at a rate of 20% on the first JEP 725,000 of income and 1% on all income above that.

Jersey resident companies are liable to tax on their worldwide income but pay rates of 0%, 10% or 20% depending on the type of company. For example a Jersey financial services company will pay 10%, a Jersey-based utility company or large corporate retailer will pay 20% and the majority of other companies will pay 0%.

Jersey introduced economic substance legislation for accounting periods beginning on or after 1 January 2019 pursuant to which companies resident in Jersey carrying on certain relevant activities have to meet an economic substance test. The relevant activities are: banking; insurance; fund management; finance and leasing; headquarters; shipping; holding company; intellectual property holding; and distribution and service centres.

Jersey signed an Intergovernmental Agreement (IGA) with the United States in 2013 to implement the exchange of information under the Foreign Account Tax Compliance Act (FATCA) and adopted the Common Reporting Standard (CRS) in 2016 with the first reporting taking place in 2017.

1.4. Local case law developments

The Jersey legislature has shown itself adept at preserving beneficial case-law principles that have been restricted by foreign judicial decisions. An obvious example is the so-called rule in Hastings-Bass, whereby trustees who had made a mistake as to their dispositive powers were able to apply to the court to have their action declared void. This allowed any adverse consequences, which were often tax-related, to be ameliorated without the need for the beneficiaries to sue the trustees for negligence or breach of trust. The principle was significantly restricted by two decisions of the United Kingdom Supreme Court in 2013 (Pitt v. Holt and Re Futter [2013] UKSC 26). Jersey immediately acted to enshrine the pre-existing principles in an amendment to the Trusts (Jersey) Law 1984, an example which has been followed by a number of other offshore jurisdictions. The Jersey courts are therefore able to continue to apply the principle in its wider form, to the benefit of beneficiaries who would otherwise have to have resorted to more lengthy and less certain litigation against their trustees for any losses incurred.

1.5. Practice trends

Although Jersey provides a tax neutral location for international private client structures, the motivation for structuring is increasingly that of succession planning or asset protection rather than tax minimisation. Clients who live in countries where there is little respect for the rule of law tend to want to hold assets in a politically stable jurisdiction with a well-developed legal system and access to high quality professional advice. Although Jersey trusts are a popular structure there is increasing interest in alternatives such as foundations, particularly where clients come from jurisdictions where the trust is relatively unknown. There is also increasing interest in trust structures where families can continue to exercise a degree of control through mechanisms such as settlor reserved powers or prescribed directions.

1.6. Pandemic related developments

Jersey’s financial institutions proved themselves to be suitably resilient when the first lockdown occurred. Jersey’s Government has for some years pursued a strategy of making the island a centre of excellence in relation to its digital sector. For example, by 2019 fibre connections were rolled out across the whole island, delivering some of the highest broadband speeds anywhere in the world. As a result the majority of private wealth businesses were able to adapt speedily to the working from home model, thus minimising disruption to their clients.

2 . Estate and trust administration

2.1. National legislative and regulatory developments

See Section 2.2 below. Although Jersey is not independent of the United Kingdom its status as a Crown Dependency gives it constitutional rights of self-government and judicial independence. Accordingly “national” and “local” developments will in this guide be treated as being the same.

2.2. Local legislative and regulatory developments

Financial services businesses, which includes trust and company administration providers, are regulated by the Jersey Financial Services Commission (JFSC). The JFSC’s responsibilities are set out in the Financial Services Commission (Jersey) Law 1998. It is well-resourced and its Supervision Division, which adopts a risk-based approach, carries out frequent inspections of regulated businesses.

The statutory framework for Jersey trusts is the Trusts (Jersey) Law 1984. The Law is subject to regular review by a working party comprising leading trust industry practitioners and representatives of government and, as a result of their recommendations, is amended from time to time. The most recent amendment is the Trusts (Amendment No.7) (Jersey) Law 2018 which, amongst other amendments:

- clarified that the reservation or grant by a settlor of all of the powers listed in the Law would not invalidate the trust;

- provided that a trustee is entitled to refuse to comply with a beneficiary’s request for information, if the trustee is satisfied that it is in the interests of any one or more, or of the whole of the beneficiaries to so refuse, subject to a beneficiary’s right to apply to the court;

- made provision for an indemnity to be granted on the retirement of a trustee by the new trustee in favour of a wide class of persons engaged in the management of the trust (such as employees) without their being made party to the relevant contract;

- permits the terms of a trust to direct or authorise the accumulation of income without requiring it to be distributed or converted to capital within a particular time period; and

- enabled the court to approve variations of a trust not just on behalf of minors but also on behalf of persons who cannot be found despite reasonable effort or falling within a large class of beneficiaries where it is unreasonable to contact each member.

The administration of estates of deceased persons domiciled in Jersey or with assets in the island is governed by the Probate (Jersey) Law 1998 and falls under the supervisory jurisdiction of the Royal Court of Jersey. Applications for grants of probate are made to a court officer known as the Judicial Greffier.

2.4. Local case law developments

Jersey’s Royal Court produces a significant number of judgments that contribute to the jurisprudence in relation to trusts and estates and its judgments are frequently cited in courts outside Jersey. Recent cases of note have concerned the existence of the so-called “substratum” rule and the role of protectors.

In Re Rysaffe Fiduciaries SARL [2021] JRC230 the Royal Court had to consider a decision by trustees to add the settlor’s widow as a beneficiary of a trust for the purposes of a reorganisation of a family’s interest in the estate and two trusts. The addition of the widow was directly contrary to the settlor’s intentions as expressed in his letter of wishes. The substratum rule, which originated in certain English cases concerning variations of trusts, suggested that an arrangement that changes the whole substratum of the trust cannot be regarded simply as a variation. The court held that there was no substratum rule in Jersey law, the test to be applied in relation to the trustees’ decision being whether the proposed exercise of the trustees’ power to add a beneficiary was permitted by the terms of the trust, whether the trustee had given adequate deliberation as to whether it should exercise the power and whether the use of the power was for a proper purpose. In the circumstances the court approved the exercise of the power to add the settlor’s widow.

In Re the Piedmont and Riviera Trusts [2021] JRC 248 the Royal Court was asked to approve a trustee’s decision as to the allocation of assets in termination of two trusts. The distribution required the consent of a protector, which had initially been refused but was subsequently given when the trustees reformulated their distribution allocation. Amongst other matters the court had to consider the role of a protector. The court held that the paramount duty of a protector is to act in good faith in the best interests of the beneficiaries. In doing so the protector was required to exercise its own judgment. Whilst the court’s judgment was still in draft it was asked to consider a decision of the Supreme Court of Bermuda in RE X Trusts [2021] Sc (Bda) 72 Civ where the court had considered whether the consent provisions in a trust deed conferred an independent decision-making discretion on the protector (the Wider View) or merely a discretion to ensure that the trustee’s substantive decision was a valid and rational one (the Narrower View). The Bermuda court had ruled in favour of the Narrower View. The Royal Court disagreed, saying that: “It seems inherently unlikely that settlors would go to the trouble of appointing themselves or trusted friends or advisors as protectors if they intended the role of protector to be limited to that of assessing rationality. If that were the case, the key requirement for a protector would be a legal qualification rather than knowledge of the settlor’s wishes and sound judgment as to what is in the best interest of particular beneficiaries”. The court did however qualify its view by pointing out that it had not heard full argument on the matter.

2.5. Practice trends

Although it is often suggested that the motive for setting up private wealth structures in jurisdictions such as Jersey is tax mitigation, the reality is that the majority of structures are set up for succession planning or asset protection. Wealth creators are increasingly concerned at the potential impact upon the next generation of inheriting substantial wealth. Increasingly cognisant of the old adage ‘rags to riches to rags in three generations” they wish to ensure that the transfer of wealth to succeeding generations is carried out in a controlled manner. The use of a trust or foundation structure in a well-regulated, tax neutral jurisdiction such as Jersey can assist in ensuring that future generations are provided for. In addition, in a world of increasing political uncertainty a structure located in a jurisdiction that respects the rule of law, has a well-respected judicial system to enforce it and ease of access to appropriate professional expertise are all attributes that help to protect the family’s assets.

Philanthropic structures have also become more common following the introduction of a new Charities Law in 2014 and the establishment of a Jersey Charity Commissioner.

2.6. Pandemic related developments

During the pandemic Jersey enacted legislation temporarily relaxing the requirement for two witnesses to be physically present when a will is signed and instead permitting this to be completed by audio/video communication, as well as the requirement for an applicant to travel to Jersey in order to obtain a Grant of Administration.

3 . Estate and trust litigation and controversy

3.1. National legislative and regulatory developments

See Section 3.2 below. Although Jersey is not independent of the United Kingdom its status as a Crown Dependency gives it constitutional rights of self-government and judicial independence. Accordingly “national” and “local” developments will in this guide be treated as being the same.

3.2. Local legislative and regulatory developments

The practice of Jersey law is regulated by the Law Society of Jersey pursuant to The Law Society of Jersey Law 2005, which provides that no person may practice law as an advocate or solicitor unless they are an ordinary member of the Law Society of Jersey. Only Jersey advocates may appear and have rights of audience in the Royal Court of Jersey. The constitution and procedure of the Royal Court in relation to civil matters is principally governed by the Royal Court (Jersey) Law 1948 and the Royal Court Rules 2004, as amended.

3.4. Local case law developments

Described by one magazine journalist as a “veritable bloodbath of litigation and rancour” the litigation concerning the Crociani family and their trustees has occupied the attention of courts in Italy, Mauritius, the Bahamas, the U.S. and Jersey for more than 10 years, with a cast of princesses, film stars and allegations of missing works of art. The case concerned a trust set up by a mother principally for the benefit of her two daughters and an allegation by one daughter that the trustee had committed a breach of trust in appointing substantial assets to a trust of which the mother was a beneficiary. The daughter was ultimately successful (see Crociani & ors. v. Crociani & ors. [2017] JRC146) and the former trustees and the mother were ordered to reconstitute the trust fund. The litigation has continued into 2021 with the latest skirmish being an application by the successful daughter for an order requiring her sister to withdraw proceedings that her sister had brought against her in Paris, essentially trying to recoup the money that the Jersey Court had ordered her to pay. However, the Paris court sat the day before the Jersey court hearing and ordered the withdrawal of the Jersey court application. The claimant in the Jersey court had no option but to withdraw her application (see [2021]JRC279) given that she risked a daily fine by the Paris court if she did not do so. The Jersey court did, however, mark its displeasure by making an indemnity costs order against the sister for what it described as the “disrespectful and manipulative actions” taken by the sister in seeking the withdrawal order in the Paris proceedings. It would appear that real-life litigation can sometimes have as many twists and turns as fictional versions.

3.5. Practice trends

Although cases with the fact pattern exhibited by the Crociani litigation may be rare, the size of Jersey’s finance industry means that trust and commercial cases will form a significant part of the work of the courts. The trust and commercial bars are significant in number and whilst only Jersey qualified advocates have rights of audience they are often assisted by representatives of London law firms and members of the English bar. Many of the cases coming before the Jersey courts are trust-related and, as a result, Jersey trust jurisprudence is substantial and frequently cited in courts of other jurisdictions. The ability of the courts to “bless” momentous decisions made by trustees has proved to be a useful resource for trustees administering large and complex trusts and can be a useful safeguard for beneficiaries of those trusts.

3.6. Pandemic related developments

The Jersey courts reacted swiftly to the restrictions imposed by lockdowns, with many hearings being conducted by video conference and papers that would ordinarily have been filed in hard copy being filed electronically. The largely positive experience has probably hastened the move by the courts towards electronic document management.

4 . Frequently asked questions

1. Why would an UHNW International family choose Jersey as the jurisdiction for their wealth structuring?

Jersey is often the jurisdiction of choice for UHNW families due to the quality of its legal system, its professional community, regulatory environment and proximity to London. It is very well-established as an International Finance Centre with a robust legislative and regulatory framework. In addition to this, given the large size of the financial services industry, there is a significant professional workforce on the island meaning access to top quality advice from industry-recognised individuals is readily available.

2. How nimble is the Jersey legal system/judiciary and are parties really given sufficient access to justice?

Jersey’s court system is very efficient and provides real access to justice. As it has a particularly sophisticated Trust law regime, this has led to the implementation of agile court processes and the development of leading private client trust law practitioners, who are seen as global leaders in their field. What this has also meant is that the Jersey judiciary has been responsible for dealing with some of the most complex and high-value trust litigation in the world and produced industry-leading judgments as a result.

3-6 PQE Corporate M&A Associate

Job location: London

Projects/Energy Associate

Job location: London

3 PQE Banking and Finance Associate, Jersey

Job location: Jersey

Sarajane Kempster

Sarajane Kempster