Sign up for our free daily newsletter

YOUR PRIVACY - PLEASE READ CAREFULLY DATA PROTECTION STATEMENT

Below we explain how we will communicate with you. We set out how we use your data in our Privacy Policy.

Global City Media, and its associated brands will use the lawful basis of legitimate interests to use

the

contact details you have supplied to contact you regarding our publications, events, training,

reader

research, and other relevant information. We will always give you the option to opt out of our

marketing.

By clicking submit, you confirm that you understand and accept the Terms & Conditions and Privacy Policy

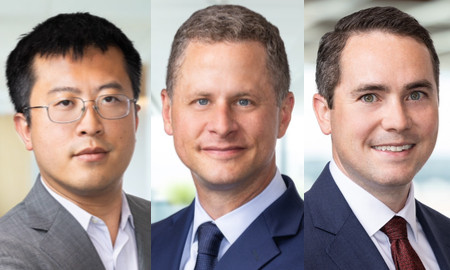

Latham & Watkins has bolstered its banking practice in London with the hire of a pair of private credit partners from Akin Gump.

Fergus Wheeler and Paul Yin have joined Latham having each spent less than a year at Akin Gump, before which they were both partners in the debt finance team at White & Case. They advise international private credit funds and direct lenders, banks, private equity sponsors and corporate borrowers on complex debt financing matters, with a focus on private credit transactions.

“We are delighted to welcome Fergus and Paul to the firm,” said Stephen Kensell, managing partner of Latham’s London office. “Their knowledge and experience of private credit is complementary to our existing capabilities in London, and their arrival will add depth to our practice.”

Wheeler and Yin regularly advise on all aspects of acquisition financing, rescue financing, restructurings, liability management solutions and cross-border special situations lending, Latham said. Their combined experience spans large-cap and mid-market transactions, and they are regarded as leading holdco financing lawyers in the City. They also have significant expertise in junior capital investment, including private high-yield and preferred equity financings.

At Latham they will work as part of a top-ranking London banking practice that houses more than 35 partners, including leading practitioners such as Kensall, Dominic Newcomb and Jayanthi Sadanandan. The team represents debt funds on deals in the European leveraged finance market and according to Chambers and Partners is “well equipped to advise on margin loan financings, bespoke finance solutions such as PIK loans, term loan B facilities and hybrid investments”.

“Private credit funds are playing an increasingly important role in Europe,” said Dan Seale, global chair of Latham’s banking practice. “Over the years we have invested significantly in building a preeminent practice and few firms can match Latham’s breadth of expertise across leveraged finance, private credit and private equity. Their experience in the private credit and debt finance arena will bring added strength to our team in London and globally.”

An Akin spokesperson commented of the duo’s departure: “Akin wishes them well in the future.”

Latham’s hire of Wheeler and Yin follows white collar crime partner Pamela Reddy joining the firm in London earlier this month from Norton Rose Fulbright.

In the summer the firm also bolstered its London private funds team with the hire of highly-rated partner Mateja Maher from Sidley Austin, shortly after leading equity capital markets specialist Mark Austin joined from Freshfields Bruckhaus Deringer.

Going the other way, in October the firm saw partner David Berman exit to lead Covington & Burling’s financial services practice in the EMEA region.

Email your news and story ideas to: [email protected]