Sign up for our free daily newsletter

YOUR PRIVACY - PLEASE READ CAREFULLY DATA PROTECTION STATEMENT

Below we explain how we will communicate with you. We set out how we use your data in our Privacy Policy.

Global City Media, and its associated brands will use the lawful basis of legitimate interests to use

the

contact details you have supplied to contact you regarding our publications, events, training,

reader

research, and other relevant information. We will always give you the option to opt out of our

marketing.

By clicking submit, you confirm that you understand and accept the Terms & Conditions and Privacy Policy

Willkie Farr & Gallagher has bolstered its energy team in Houston with the hire of a partner from Shearman & Sterling, ahead of the latter’s merger with Allen & Overy.

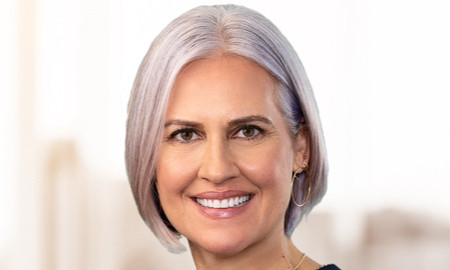

Sarah McLean has joined the 1,200-lawyer firm as a partner in the corporate and financial services department and private equity practice after almost six years at Shearman, where she was joint head of the US energy industry group.

McLean brings more than 20 years’ experience advising private equity funds and management teams on deals across the energy sector and primarily acts for sponsors in making portfolio investments, growing their platform companies and exiting their investments.

“Sarah is a standout private equity and energy lawyer and we are pleased to welcome her to Willkie,” said firm chairman, Thomas Cerabino. “She brings significant dealmaking experience to our global energy team in Texas and across the US and Europe and will be an invaluable resource to our clients navigating the changing energy market.”

At Shearman McLean worked with clients including EnCap Flatrock Midstream, Oryx Midstream and Silver Hill Energy Partners on numerous deals. She is the sixth partner to join Willkie’s energy team over the past year, following the hire of private equity specialist Tony Johnston and M&A lawyer Tan Lu in Houston from Kirkland and Ellis and Vinson & Elkins respectively.

Last September the firm also hired a trio of renewable energy partners in New York and Los Angeles from Mayer Brown, including Eric Pogue, who joined as global chair of power and renewable energy.

McLean commented: “Willkie has leading private equity and transactional capabilities, a fast-growing energy platform and a collaborative culture across the firm. I’m excited to join the team here and strengthen Willkie’s work across the energy sector to support the growing needs of our clients.”

McLean’s departure comes ahead of Shearman’s planned merger with Allen & Overy, which is expected to be completed by May of this year. The merged firm – to be known as A&O Shearman – will have almost 4,000 lawyers across 48 offices globally and revenue in the region of $3.5bn.

A Shearman spokesperson commented: “As a firm we are dedicated to serving our clients at the highest level, while we continue to advance the A&O Shearman integration planning as we move toward final close of our merger.

“Upon completion of the transaction, A&O Shearman will have a powerhouse private equity and energy offering. We thank Sarah for the contribution she has made to the firm and wish her all the best for the future.”

Shearman saw a slew of partner departures in the run up to its merger vote with A&O last October, particularly in Europe and the Middle East, including virtually its entire German arm decamping to Morgan Lewis last March on the same day the firm said its merger talks with Hogan Lovells had broken down.

Such departures are a common response to mergers, particularly in markets where both firms have an established presence.

However both Shearman and A&O have been bullish about the opportunities their tie-up represents and touted the enthusiasm for it among their respective partnerships, which was underscored by the fact that more than 99% of the votes cast at each firm were in favour of the merger – far higher than the 75% needed for it to be approved.

Email your news and story ideas to: [email protected]